How to Get More Clients as a Therapist Through Better Marketing

Discover practical marketing strategies to attract more clients as a therapist. This guide offers st...

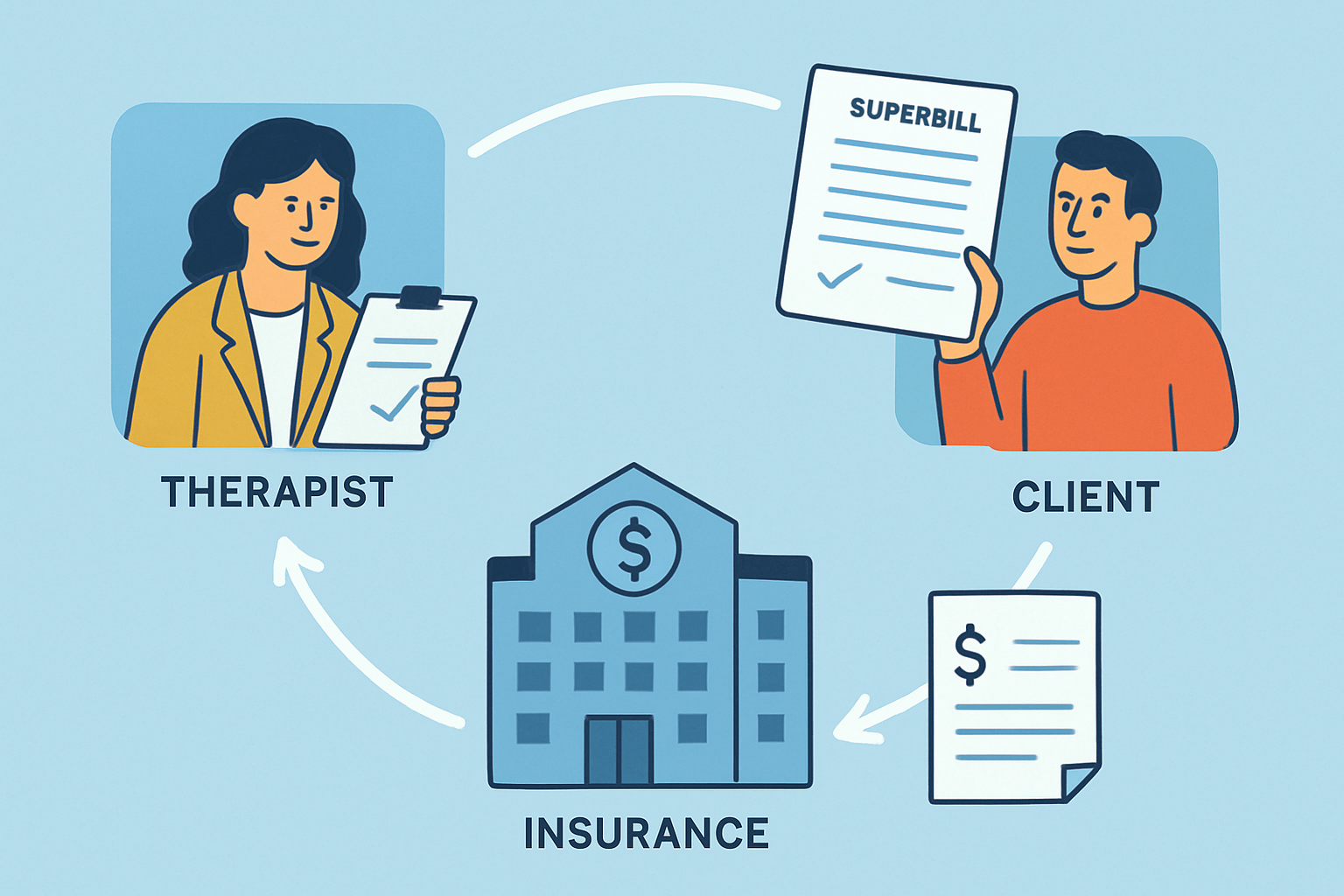

Therapists often come across the term "superbill" when navigating the maze of billing and insurance though it can sometimes feel fuzzy or confusing. A superbill is an important piece of the puzzle because it links therapists, clients and insurance companies in a way that keeps things running smoothly behind the scenes.

A superbill is essentially a detailed invoice or receipt that therapists hand over to clients after a therapy session. It clearly shows the important info an insurance company needs to process claims when clients want reimbursement. You’ll typically find the services provided, service codes, fees charged, session dates and the provider’s credentials all compiled in one handy document.

Sometimes the smallest details make the biggest difference, and when it comes to therapy, superbills are one of those unsung heroes that keep things running smoothly behind the scenes.

Superbills play an important role because they give clients a way to request reimbursement for therapy when their therapists aren’t in-network with insurance providers. Many insurance plans require proof of services with specific codes and details. This is where superbills come to the rescue. Without a proper superbill, clients often jump through hoops to file claims or face delays in getting reimbursed.

Think of a superbill as the trusty bridge between the therapist’s services and the insurance company’s reimbursement process. It’s there to catch all the details, making sure the paperwork is spot-on and complete so payment doesn’t get held up. In my experience, having this little helper keeps things running smoothly and on time.

Superbills give therapists a real leg up by smoothing out the reimbursement process for clients and slashing the usual back-and-forth with insurance companies. They also keep financial records neat and tidy for everyone involved.

Breaking down a superbill into its basic parts really helps therapists keep things accurate when they’re preparing these documents.

| Element | Description | Why It Matters |

|---|---|---|

| Therapist Name & Credentials | The therapist’s full name paired with their professional qualifications — the official creds | This nails down exactly who’s providing the care and makes sure the insurance people trust the credentials |

| Dates of Service | The exact dates when those therapy sessions actually happened | Pinpoints the when and how long behind the treatment, which really helps smooth out the processing |

| CPT Codes | The standard codes used to specify the exact services delivered | These codes are like the language insurance uses to recognize what was provided |

| ICD-10 Codes | Diagnostic codes that lay out the client’s mental health conditions in detail | They back up the medical necessity of each service for insurance purposes, no ifs or buts |

| Fee Charged | The dollar amount billed for every individual service or session | Clearly shows the charges so insurance can figure out what to reimburse |

| Payment Details | Records tracking payments made or any balances still hanging around | Keeps everything crystal clear and honest on the financial side |

| Provider NPI Number | That one-of-a-kind National Provider Identifier assigned to the therapist | Absolutely essential for submitting claims, whether electronically or by hand |

Therapists often whip up superbills either by hand or using practice management software that takes care of most of the heavy lifting automatically. The key thing is making sure every bit of information is spot on and complete, so clients can breeze through submitting their claims without a hitch.

Using electronic health record (EHR) systems and billing software can really help cut down on errors and save some much-needed time. Plenty of up-to-date platforms let therapists enter session details just once and then automatically generate superbills, complete with spot-on CPT/ICD-10 codes pulled from the latest medical code libraries.

A lot of therapists often find coding systems baffling and usually struggle to keep up with the changing landscape of insurance policies. They’re typically racing against the clock when putting together superbills for clients. These hurdles can lead to slip-ups, slow down reimbursements and leave clients feeling frustrated

Therapists can tackle these challenges by staying in the loop with coding changes through ongoing education and using up-to-date billing software. They can also break down the superbill process clearly for their clients and keep handy reusable superbill templates to speed up preparation.

Clients usually receive superbills from their therapists right after their sessions, which they then hand off to their insurance providers to seek reimbursement.

Superbills are a must-have for therapists working with clients who want to navigate the sometimes tricky world of insurance reimbursement, especially when they are out-of-network. They lay everything out in plain sight, making it a whole lot easier for clients to tap into their benefits and smoothing out the bumps in the billing process.

Discover practical marketing strategies to attract more clients as a therapist. This guide offers st...

Master simple yet powerful organization techniques tailored for therapists. Improve your workflow, s...

Learn actionable steps therapists can take to boost therapist referrals, enhance credibility, and ex...

Discover the essential features of therapy practice management software that enhance efficiency, com...